Contpark specializes in offering a robust terminal management solution. Its platform includes features for real-time visibility, workflow automation, and security, simplifying terminal operations and increasing productivity.

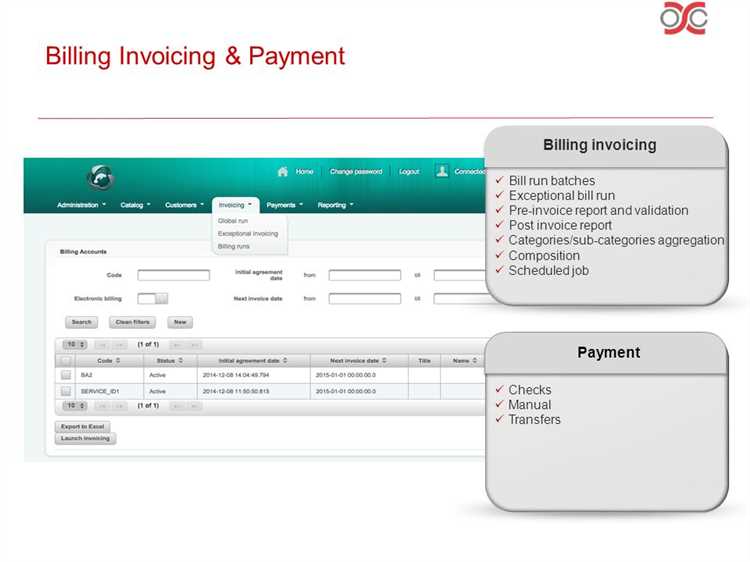

Managing billing and payment processes efficiently is crucial for any business. An invoicing system can simplify these tasks by automating payment tracking, invoice management, and customer management. With the help of payment integration and payment gateway services, businesses can process transactions seamlessly, ensuring timely payments and maintaining a steady cash flow.

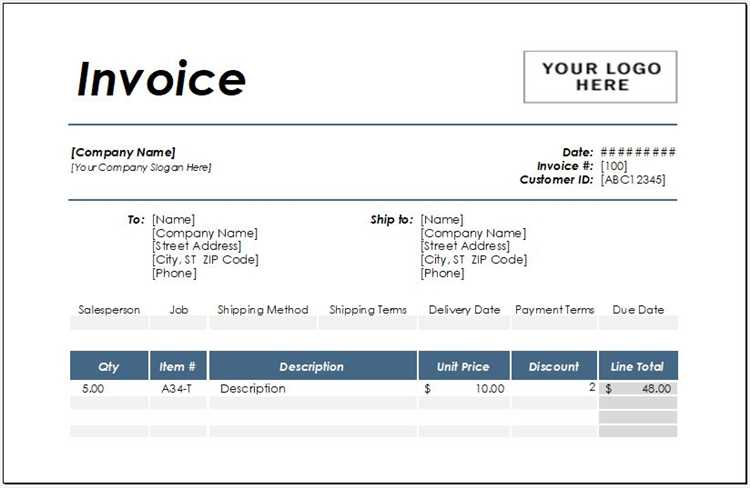

One of the key features of an invoicing system is its ability to generate invoices and export them in various formats, such as PDF or CSV. This not only helps to streamline the billing process but also ensures that records are easily accessible for auditing purposes.

Online invoicing software offers multilingual capabilities, allowing businesses to cater to customers from different countries. Moreover, the software provides a user-friendly interface and API integration, enabling seamless communication with other business systems.

Besides invoicing and payment processing, billing software also provides features such as payment history, reporting, and notifications. Through detailed reports, businesses can gain insights into their financial status and track their profit. The software also allows for easy date scheduling, ensuring that invoices are generated and sent on time to avoid late payments and penalties.

Another significant advantage of using an invoicing system is efficient taxation management. The software can automatically calculate taxes based on predefined rules and generate accurate tax reports. This helps businesses stay compliant with tax regulations and reduces the risk of errors.

Furthermore, invoicing software offers subscription management and billing options. It allows businesses to set up recurring payments and manage subscriptions effectively. This feature is particularly useful for businesses with a subscription-based model, ensuring a seamless billing process for customers.

Invoices and payment histories are securely stored and archived within the software. This helps businesses maintain organized records and facilitates easy retrieval when needed. Additionally, invoicing systems provide backup options, ensuring the data is safe from any potential loss.

By implementing an invoicing system, businesses can streamline their billing and payment processes, making them more efficient and accurate. With features such as payment automation, payment gateway options, and customer management, the software becomes an indispensable tool for businesses of all sizes.

Improved Financial Management: An invoicing system provides a centralized platform for managing all billing and payment processes. It allows businesses to track and monitor expenses, generate invoices, and keep a record of payment status. This streamlined approach enhances financial efficiency and helps in better financial planning.

Efficient Payment Processing: Billing and payment software automates the payment processing tasks, reducing the manual effort and time required. With the integration of a payment gateway platform, customers can make payments using various payment methods, and the software verifies and authorizes the payment seamlessly. This accelerates payment processing, improves cash flow, and minimizes the risk of late payments or debt.

Enhanced Customer Support: The invoicing system allows businesses to communicate effectively with their customers. It enables the generation of customized invoices, sends payment reminders and notifications, and provides customers with payment receipts and statements. This proactive communication improves customer satisfaction and strengthens the business-customer relationship.

Streamlined Expense Tracking: With an invoicing system, businesses can easily track and categorize expenses related to each customer or project. This enables accurate expense reporting and ensures that all expenses are accounted for. The software also provides detailed payment analytics, allowing businesses to analyze payment trends and make informed financial decisions.

Scalable and Customizable: Invoicing systems are scalable and can be customized to meet the specific needs of a business. They can handle a growing customer base and increasing invoice volume without compromising efficiency. The software can be tailored to include features such as estimates, payment integration with other finance applications, and automated report generation.

Accessible Anytime, Anywhere: Invoicing software is accessible through web or mobile applications, allowing businesses to manage their billing and payment processes from anywhere at any time. This flexibility ensures that businesses can stay updated on their financial transactions and respond to customer inquiries promptly.

Integration with Payment Gateway Services: The integration of an invoicing system with payment gateway services enables businesses to accept payments online securely and efficiently. It ensures that payment information is encrypted and provides a seamless payment experience for customers. This integration eliminates manual data entry and reduces the risk of errors, enabling businesses to focus on core operations.

Efficient Inquiry Management: An invoicing system provides a centralized platform for managing customer inquiries and resolving payment-related issues. It allows businesses to easily track and respond to customer inquiries, ensuring timely and effective customer support. This streamlined inquiry management process improves customer satisfaction and reduces the risk of payment disputes.

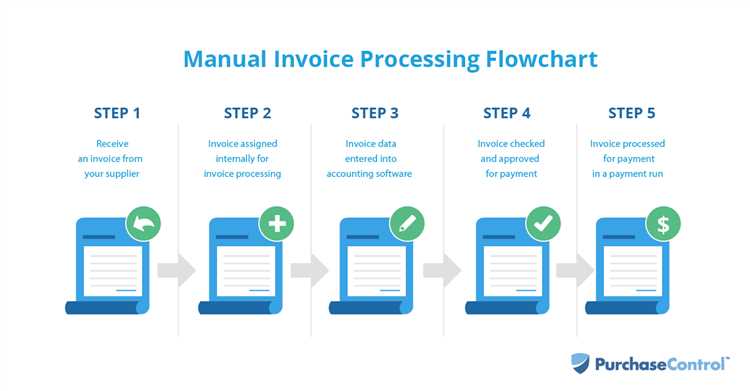

Streamlining your billing and payment processes is crucial for the success of your business. Manual invoicing can be time-consuming and prone to errors, leading to delayed payments and financial complications. By utilizing advanced billing and payment software, you can automate these processes and ensure a smooth and efficient system for both you and your clients.

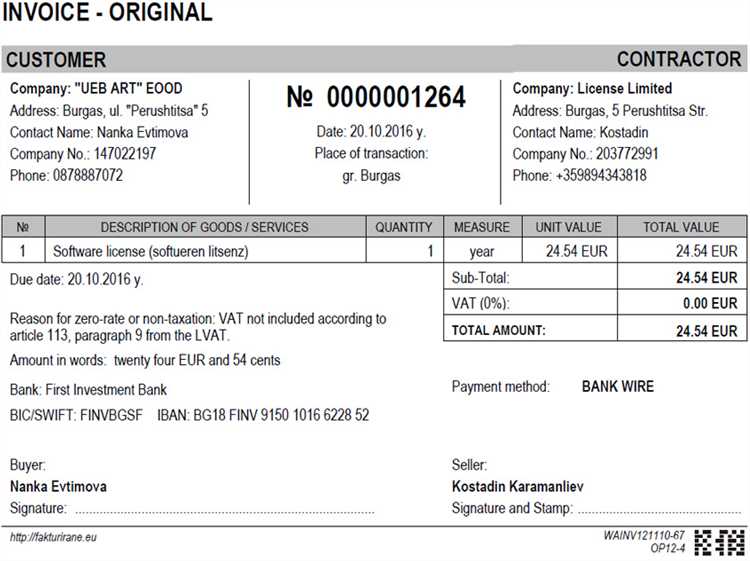

With payment processing software, you can easily generate professional invoices that include all the necessary details, such as item descriptions, quantities, and prices. This software also allows you to customize your invoices to match your business’s branding, giving them a more professional look that leaves a lasting impression on your clients.

One of the key features of billing and invoicing software is the ability to send payment reminders to your clients automatically. This helps eliminate late or missed payments, ensuring a steady cash flow for your business. The software can also handle payment cancellations, refunds, and adjustments, keeping your records accurate and up to date.

Efficient collaboration with your suppliers and vendors is essential for a successful business. Invoicing software enables seamless collaboration by providing a platform where you can easily communicate and share invoice-related information. This allows you to resolve any billing issues promptly, ensuring a healthy business relationship with your partners.

The benefits of billing and payment software extend beyond the invoicing process. These solutions usually include comprehensive payment reports, giving you insights into your business’s financial performance. You can track payments, identify overdue invoices, and analyze your profit generation. The software can also handle credit card processing and other payment gateway integrations, allowing you to offer various payment options to your clients.

Moreover, billing and payment software often supports multilingual capabilities, allowing you to create invoices, payment notifications, and payment alerts in different languages. This feature is particularly beneficial if your business operates on an international scale, enabling you to cater to the needs of diverse clients effectively.

In conclusion, automating your invoicing process with billing and payment software is a wise investment to streamline your financial operations. This software simplifies the generation and management of invoices, ensures timely payments, and provides valuable insights into your business’s financial health. Upgrade your billing and payment system today and experience the efficiency and convenience it brings to your business.

Billing and payment software is a comprehensive system that streamlines the entire billing process, making it more accurate and efficient. With this software, businesses can easily manage their pricing, cash flow, and payment scheduling. The system allows for easy archiving and financial management, making it simpler to keep track of transactions and records.

One of the key features of billing and payment software is recurring billing. This allows businesses to set up automated billing for regular customers, eliminating the need for manual invoicing and reducing the risk of errors. The software also allows for invoice customization, with user-friendly templates that can be personalized to match a business’s branding.

Collaboration is made easier with billing and payment software as well. Businesses can easily share invoices and receipts with their clients, improving communication and reducing the chance of payment delays or misunderstandings. The software also provides a platform for clients to make inquiries about invoices or expenses, ensuring that any issues can be quickly resolved.

Cloud-based invoicing systems offer additional benefits, such as the ability to access invoices and records from anywhere and export them for further analysis. The software may also include analytics tools, which can provide valuable insights into billing and inventory management.

Payment processing solutions and payment gateway integration are important features of billing and payment software. These features allow businesses to easily process payments and provide a variety of payment options to their customers. They also enable secure and efficient payment cancellation and management of recurring payments.

Overall, billing and payment software improves accuracy and efficiency in the billing process. It automates tasks, reduces errors, and provides a user-friendly platform for collaboration and financial management. Businesses can benefit from streamlined invoicing, faster payment processing, and improved record-keeping.

With a robust billing and payment software, you can generate professional invoices effortlessly. The software allows you to create invoices for your orders with just a few clicks, eliminating the need for manual data entry and reducing the chances of errors.

The app provides payment automation, making it easier for you to process payments and track expenses. It integrates with credit card processing and payment gateway solutions, ensuring secure payments for your customers.

Moreover, the software offers billing alerts and payment reminders, helping you stay organized and ensuring timely payments. You can set up payment authorization and receive notifications when payments are made, giving you more control over your finances.

The accessible payment platform also allows for multilingual support, enabling you to serve customers from different regions seamlessly. It even integrates with cloud accounting and CRM systems, making it convenient to manage your records and vendor relationships.

If you need to manage supplier payments, the software offers payment processing solutions tailored to your needs. You can process payments online, track payment statuses, and even issue refunds or cancellations when necessary. The software provides an API for easy integration with other services, giving you flexibility and customization options.

Overall, a billing and payment software streamlines your invoicing process, increases efficiency, and ensures secure and convenient payment processing. It’s an essential tool for businesses looking to streamline their billing and payment operations, and keep their cash flow healthy.

Efficiently manage your finances with the help of powerful accounting features offered by billing and payment software. Keep track of all your invoices and balances, ensuring that payments are made on time and financial records are up-to-date.

Customize your invoices to reflect your brand and business needs. Create professional-looking invoices that provide clear payment instructions and relevant details. With customizable templates, you can easily generate invoices that align with your brand identity.

Streamline your billing process with recurring payments. Set up automated payment schedules for your customers, eliminating the need for manual intervention every time a payment is due. This allows for scalable invoicing, as you can easily manage a large number of recurring payments without hassle.

Efficiently archive all your billing and payment data with cloud-based software. Access and retrieve important data whenever you need it. Stay on top of your payments with automated payment notifications, ensuring that both you and your customers are kept informed about upcoming payments and due dates.

Harness the power of analytics to gain insights into your billing and payment processes. Analyze payment trends, identify areas of improvement, and make data-driven decisions to optimize your financial operations. Seamlessly integrate with payment gateway tools to provide convenient payment methods for your customers.

Simplify the approval process by setting up workflows that require various levels of authorization for billing and payment tasks. This ensures that all payments are properly reviewed and approved before being processed. Reconcile payments received with the corresponding invoices to maintain accurate financial records and avoid discrepancies.

Generate invoices quickly and effortlessly with built-in invoice generation features. Customize your invoice layouts and add relevant details such as payment due dates and terms. With mobile payment capabilities, accept payments on the go and provide your customers with convenient payment options.

Deliver responsive and accurate statements to your customers, complete with itemized billing information and payment history. Ensure transparency and build trust with your customers by providing them with clear and understandable statements. Seamlessly reconcile payments received with the corresponding invoices to maintain accurate financial records.

Generate receipts automatically when payments are made, providing your customers with proof of payment. Use payment gateway solutions to securely process payments and protect sensitive financial information. Offer multiple payment options to accommodate your customers’ preferences and increase convenience.

Streamlining your billing and payment process is crucial for efficient financial management. With the right billing and payment software, you can simplify and automate recurring invoices to ensure prompt payment and improve cash flow.

One of the key features of billing and payment software is its ability to set up recurring invoices. This functionality allows you to create and schedule regular transactions with your customers and suppliers. By automating this process, you can save time and reduce the risk of errors in billing.

The software provides comprehensive billing reports that give you insights into your financial transactions. You can easily track and manage all invoices, payments, and receipts through a user-friendly interface. This helps you stay on top of your finances and ensure accurate documentation for taxation purposes.

Integration with CRM systems enables personalized customer communication and improved collaboration with your team. You can set up payment reminders and notifications to ensure timely payments and avoid any late fees or penalties. With mobile and cloud-based access, you can manage your invoicing system anytime, anywhere, giving you the flexibility to stay connected even on the go.

The billing and payment software also provides a secure and efficient payment platform. It supports various payment solutions, including credit card processing and mobile payments, allowing your customers to choose the most convenient option. In case of any payment issues or refunds, the software offers streamlined payment refund processes.

With subscription management capabilities, you can easily manage recurring payments and subscriptions for your customers. This eliminates the need for manual invoicing and helps you maintain a steady cash flow. Additionally, the software offers integration with accounting systems, ensuring seamless financial data synchronization and reliable financial reporting.

In conclusion, implementing a comprehensive billing and payment software with recurring invoice functionality can significantly improve your financial management. It simplifies the invoicing process, provides real-time insights, enhances customer communication, and ensures secure and efficient payment processing. By streamlining your billing and payment system, you can focus more on your core business activities and achieve better financial outcomes.

Billing and payment software offers businesses a range of customization options to streamline their invoicing system. From archiving accounts to customizable credit and payment gateway integration, these tools provide a comprehensive solution for managing financial transactions.

One key feature of billing and payment software is the ability to generate customized invoices. Businesses can create invoices that reflect their unique branding and include specific information such as order details, scheduling, and payment terms. This customization helps maintain a consistent and professional image across all client communications.

Another important aspect of billing and payment software is the ability to integrate with various payment gateway providers. This integration allows businesses to offer their customers multiple payment options, such as credit card, PayPal, or bank transfer. By providing different payment gateway options, businesses can cater to the preferences and needs of their clients.

In addition to invoice generation and payment processing tools, billing and payment software also offers features for payment reconciliation and reporting. The software automatically reconciles payments received with the corresponding invoices, ensuring accurate and up-to-date financial statements. Business owners can easily generate billing reports to track payment flow and analyze their financial performance.

The interface of billing and payment software is designed to be user-friendly and customizable. It can be configured to support multiple languages, making it accessible to businesses operating in different regions. The software is also responsive, allowing users to access and manage billing and inventory management on various devices, such as computers, tablets, and smartphones.

With the customization options available in billing and payment software, businesses can streamline their billing and payment system, improve financial management, and provide a seamless payment experience for their clients.

Managing taxes can be a complex and time-consuming task for businesses. However, with the help of a robust invoicing system, taxation can be simplified and streamlined. The software’s payment authorization feature ensures that only authorized payments are made, reducing the risk of unauthorized transactions. Furthermore, the system keeps track of important dates, such as tax deadlines and payment due dates, so businesses can stay organized and avoid penalties. Payment verification tools also provide an added layer of security, ensuring that payments are valid and accurate.

The software’s reporting capabilities are essential for taxation purposes. It generates comprehensive reports that outline all the necessary financial information, making it easier for businesses to prepare their tax returns. Additionally, the system sends notifications when tax invoices are due, helping businesses stay on top of their tax obligations. Furthermore, the software allows for easy export of financial data to accounting software, facilitating the tax preparation and reporting processes.

With the invoicing system’s invoice customization feature, businesses can tailor their invoices to include all the required tax information. This ensures that the invoices are compliant with tax regulations and makes it easier for businesses to claim tax credits or deductions. Moreover, the system’s billing alerts notify businesses of any discrepancies or errors in their invoices, allowing for prompt corrections and preventing any issues with tax accounting.

The software’s automated calculations feature eliminates manual calculations, reducing the risk of errors and saving businesses time. It accurately calculates tax amounts based on the applicable tax rates, ensuring compliance with tax requirements. Additionally, the system keeps track of accounts receivable and accounts payable, making it easier for businesses to reconcile their payments and manage their cash flow.

The invoicing system’s payment processing tools enable businesses to accept secure payments from their customers. It offers payment integration with popular payment gateways, allowing for seamless transactions and reducing the risk of fraud. Furthermore, the software’s payment refund feature simplifies the process of refunding payments, ensuring timely and accurate reimbursement.

In conclusion, an invoicing system with billing and payment software is a valuable tool for simplifying taxation. It automates and streamlines various aspects of the tax process, such as payment authorization, dates and system, payment verification, reporting, invoice customization, notifications, and payment processing tools. With its robust features, businesses can effectively manage their tax obligations, maintain accurate financial records, and ensure compliance with tax regulations.

Implementing an invoicing system with integrated billing and payment software can greatly enhance the overall customer experience. The integration of various payment gateway options within the software allows customers to easily make payments using their preferred method, whether it be credit card, online payment or even payment refund. This flexibility increases customer convenience and satisfaction.

The payment software also provides advanced expense tracking and management features for customers, giving them a comprehensive view of their financial transactions and payment history. Late payment reminders and automatic calculations for services rendered are included, ensuring customers stay on top of their billing cycle and avoid any late fees.

The cloud-based invoicing system offers collaborative capabilities, allowing customers and businesses to work together more efficiently. Customers can collaborate with their insurance providers, for example, by providing access to payment reports or approving payments. This streamlines the payment approving process, resulting in faster and more accurate financial management.

Recurring billing is another feature offered by the billing and payment software. This means that customers can set up automatic payments for recurring services, such as monthly subscriptions or insurance premiums. This eliminates the need for manual payments and saves customers time and effort.

Personalization is another key benefit of using billing and payment software. The software allows customers to personalize their invoices, adding their company logo or adjusting the format to align with their brand. This adds a professional touch to the invoicing process and helps strengthen the customer’s brand identity.

Overall, implementing a billing and payment software system not only improves the efficiency of the billing process but also enhances the customer experience. With features such as integrated payment options, expense tracking, collaboration, and personalization, customers can easily manage their financial transactions, stay on top of their bills, and enjoy a seamless payment experience.

Integrating your billing and payment software with your accounting software is a crucial step towards efficient and streamlined financial management. By seamlessly synchronizing data between the two systems, you can ensure accurate record-keeping and a seamless payment processing system.

With integrated billing and payment software, you can easily track payment history, generate invoices, and manage billing cycles. The software allows for invoice customization, ensuring that each invoice accurately reflects the services provided and fees incurred. This integration also allows for efficient expense tracking, keeping vendor records up to date.

Online invoicing and payment automation are made possible through the integration of the billing software with accounting systems. This digital payment processing platform enables secure payments and provides customers with a convenient payment gateway solution.

In addition, payment reconciliation becomes a breeze with integrated systems, as the payment management software automatically updates financial records and tracks all payments received. This modern solution eliminates manual data entry and human errors, saving time and improving accuracy.

By integrating your billing and payment software with accounting systems, you not only streamline your invoicing and payment processes but also improve overall financial management. The seamless flow of data ensures that your records are always up to date, allowing you to make informed business decisions and enhancing customer satisfaction.

In today’s digital age, security and data protection are of utmost importance in any billing and payment software. With the increasing number of cyber threats and data breaches, businesses need to ensure that their financial transactions and sensitive information are safeguarded.

One crucial aspect of secure payments is the use of payment gateway plugins, which encrypt and protect customer payment information. These plugins enable businesses to securely process transactions and provide customers with multiple payment options.

Furthermore, billing and payment software also come with features like customer management and purchase approvals, allowing businesses to efficiently manage their accounts and maintain a secure financial management system. This includes generating and sending customer invoices, managing purchase orders, and facilitating communication with suppliers.

Cloud-based billing and payment software offer an added layer of security as all data is stored securely on remote servers. This eliminates the risk of data loss or theft associated with traditional paper invoices. Additionally, cloud-based software allows for easy scalability and customization to meet the unique needs of each business.

Moreover, these software solutions also offer robust reporting and alert systems, enabling businesses to keep track of their finances and identify any unusual activities. Alerts can be set up for payment cancellations, tax alerts, profit notifications, and more, ensuring that businesses stay on top of their financial performance.

Billing and payment software often come with integrated payment solutions, enabling businesses to offer a variety of payment options to their customers. From online payments to receipts and remittance, these software solutions streamline the payment process and enhance customer satisfaction.

Additionally, APIs can be used to integrate billing and payment software with other systems, such as accounting software, further enhancing financial management capabilities. This integration ensures seamless data flow and simplifies the reconciliation process.

The responsive nature of billing and payment software allows businesses to create, send, and track invoices from anywhere, at any time. This flexibility enhances efficiency and improves communication with customers and suppliers.

In conclusion, secure payments and data protection are core components of billing and payment software. With features like payment gateway plugins, cloud-based storage, and customizable options, businesses can streamline their billing and payment processes while ensuring the utmost security for sensitive financial data.

By implementing a modern billing and payment software, businesses can experience significant cost savings and a high return on investment. The software automates the billing and invoicing process, eliminating the need for manual data entry and reducing the chances of errors. This streamlines the entire billing process and saves time and resources for the company.

One of the main cost-saving benefits is the integration of payment options into the software. With payment integration, customers can easily make payments using their preferred method, such as credit cards, online banking, or digital wallets. This reduces the need for additional payment gateway solutions or plugins, and simplifies the payment process for both the customer and the business.

The software also provides tools for efficient invoice management. It enables businesses to schedule recurring invoices, track payments, and send automated payment reminders to customers. With these features, businesses can reduce the number of outstanding payments and improve cash flow. Additionally, the software provides detailed analysis and reports on billing statements, outstanding payments, and tax calculations, enabling businesses to accurately track their financial performance.

Furthermore, the billing and payment software can handle multilingual billing, which is particularly beneficial for businesses with an international customer base. The software supports multiple currencies and languages, making it easier to serve customers in different regions and streamline the billing process across borders.

Another cost-saving aspect is the integration of billing and inventory management. The software can automatically update inventory levels when invoices are generated and payments are received, eliminating the need for manual data entry and reducing the risk of stockouts or overstocking. This ensures a more accurate and efficient workflow, ultimately saving costs for the business.

In conclusion, implementing a modern billing and payment software not only streamlines billing and invoicing but also brings cost-saving benefits and a high return on investment. With features like payment integration, invoice management, multilingual billing, and billing and inventory management, businesses can save time and resources, improve cash flow, and enhance customer experience. Additionally, the software provides secure payment processing solutions and detailed analysis for better financial management.

In today’s digital age, businesses are constantly searching for ways to streamline their billing and payment processes. One solution that has proven to be efficient and effective is billing and payment software. This software automates the entire invoicing process, from creating and sending invoices to tracking expenses and receiving payments.

With billing and payment software, businesses can easily create and send invoices online. This eliminates the need for manual invoicing, reducing the chances of errors and saving time. The software also provides payment notification to both the business and the customer, ensuring transparency and timely payments.

Approvals and late payment reminders are also features of billing and payment software. Businesses can set up approval workflows, allowing multiple parties to review and approve invoices before they are sent out. Additionally, the software can send automated reminders to customers who have overdue invoices, helping to improve cash flow.

Billing and payment software also offers advanced invoice management and collaboration capabilities. Businesses can easily track and organize their invoices, with features such as a billing dashboard and payment history. Collaboration is made easy with the ability to communicate and resolve inquiries directly within the software.

Integration with a payment gateway is a crucial feature of billing and payment software. This enables businesses to receive payments online, securely and conveniently. Payment gateway services allow for various payment methods, such as credit cards, mobile payments, and online banking. The software can also handle subscription management for businesses that offer recurring billing.

Furthermore, billing and payment software is often multilingual, making it accessible to businesses operating globally. It also provides comprehensive reporting capabilities, allowing businesses to track their revenue, expenses, and fees. Scheduling and reminders features help businesses stay on top of their billing cycle.

In conclusion, billing and payment software is an essential tool for businesses looking to streamline their invoicing process. It offers a wide range of features, from online invoicing and payment processing to advanced reporting and collaboration capabilities. By adopting such software, businesses can improve their efficiency, accuracy, and communication, ultimately leading to enhanced financial management.

Billing and payment software is a type of technology that helps businesses manage their invoicing and payment processes. It automates tasks such as generating invoices, tracking payments, and sending reminders to customers.

Billing and payment software works by integrating with a business’s existing systems, such as accounting software or CRM. It collects data on sales, orders, and customer information, and uses that data to generate invoices automatically. It can also track payments and send reminders to customers for overdue payments.

The benefits of using billing and payment software include increased efficiency, reduced errors, faster payments, improved cash flow, and better customer satisfaction. It can also save businesses time and money by automating tasks that would otherwise be done manually.

When choosing billing and payment software, you should look for features such as invoice customization, automated payment reminders, online payment options, integration with accounting software, reporting capabilities, and scalability to accommodate future growth.

Billing and payment software is designed to be secure and protect sensitive customer information. Look for software that uses encryption and other security measures to keep data safe. You should also choose a provider that is compliant with industry standards, such as PCI DSS, to ensure the highest levels of security.

Yes, billing and payment software can help with recurring billing. It can automate the generation and sending of invoices for recurring charges, and can also set up automated payment schedules for customers. This can save businesses time and ensure that invoicing and payments are processed on time.